facing the future with confidence

how we work to build members' confidence

We do this by supporting our members through every step of their journey with us, by delivering digital tools and experiences that help them make the most of their super.

Research and insights

Our research and insights help us understand and support our members. We ask them what they need, and we invest in technology that makes things easier. With these insights, we design products, tools and services that connect members to their super.

Expert advice and help services

We believe in the value of quality advice to help improve financial outcomes for our members.

HESTA members can access advice whenever they need it from our expert teams, over the phone or face-to-face.

We offer several advice options for members, including:

Super health check

A super health check is designed to help members:

- learn how much they’re likely to have in retirement

- find out what a transition to retirement plan could look like

- choose the right investment option for them, and

- understand the different ways to contribute extra to their super.

Our super health check service is available to members at no extra cost.

Retirement Hub

Our Retirement Hub helps support members to transition smoothly to enjoying life after work.

Through the Retirement Hub, our members can:

- find out about the financial options available to them

- get support with their Retirement Income Stream application

- check their Centrelink entitlements

- get help applying for the Age Pension, and

- get access to estate planning services through our referral service.

Members can get extra help, including personal retirement advice or support with their Centrelink application. We disclose upfront any fees that would apply. Visit the Retirement Hub.

Information sessions

We run regular information sessions on a range of topics relevant to our members’ different life stages. Find out about our super and retirement information sessions.

Support with the right tools

We’ve used both our research and investment in technology to develop tools to help members make informed financial decisions about their super.

Options to manage super online

Online account

Members can manage their super online, anytime, to get the full picture of how they’re tracking.

Our members can access their online account to:

- check their transactions and download their current and past statements

- combine their super

- change their investment options

- apply for or change their insurance cover, and much more.

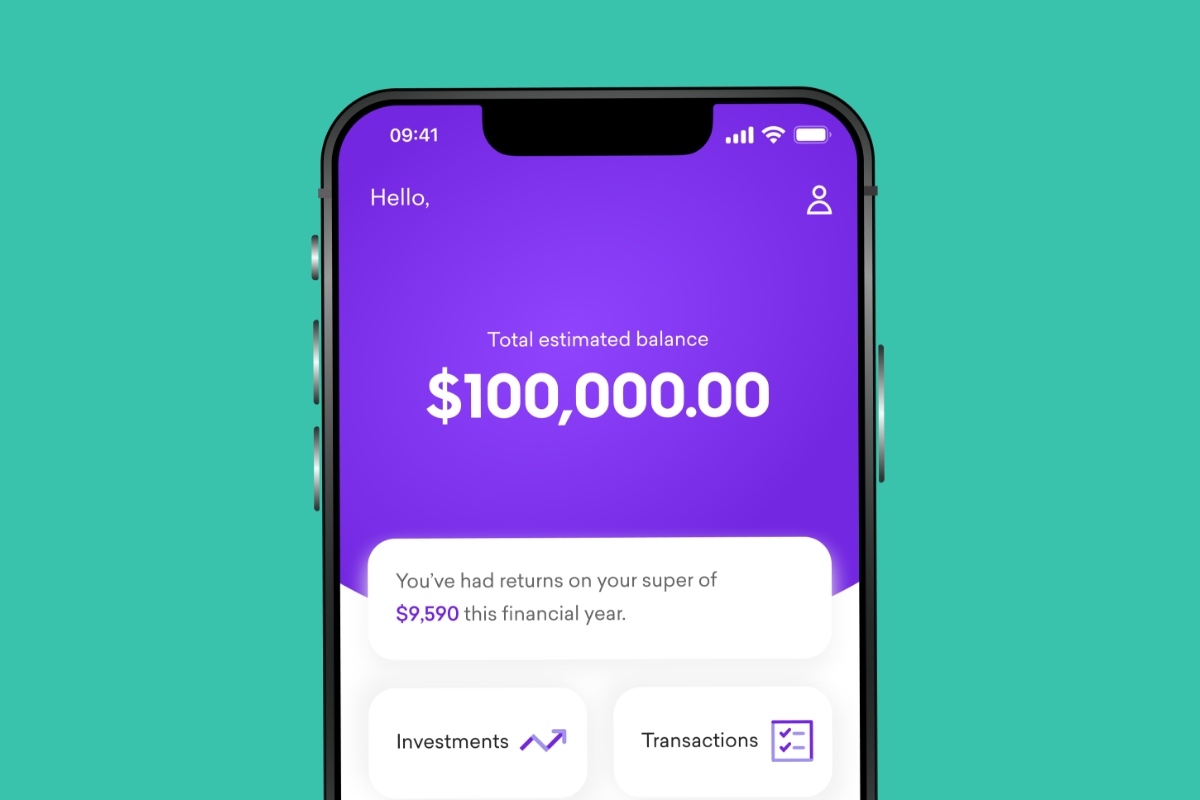

The HESTA App

Our app lets members access their super or income stream account from anywhere with a PIN or biometrics like face recognition and fingerprint ID.

Our members can use the app to:

- view their account balance, transactions and most recent contributions

- see their investment options and investment earnings

- update their mobile phone number and email address

- view our fund details to provide to their employer

- get their BPAY® details to make after-tax super contributions into their account

- download their recent annual statements

- view recent and upcoming income stream payments (Income Stream members only).

Find out more about how our members can manage their account online.

For illustrative purposes only.

Future Planner

Future Planner is a digital tool that aims to empower our members with help to improve their financial wellbeing.

This member-only tool lets members see how much money they're projected to have in retirement, see how their projected annual household income compares to the Association of Superannuation Funds of Australia (ASFA) comfortable retirement standard, and explore their options to grow their super.

Our members can log in to their online account to access Future Planner.

Risk profiler

Our Risk Profiler tool helps members understand their attitude towards risk, so they can make more informed decisions about how to invest their super and the types of investments that could be right for them.

Try our Risk Profiler tool.

We also have a range of simple online tools to help our members start planning for the future.

Find out about our tools and calculators.

stories and insights

We regularly develop content to help members better understand and manage their super and finances and support their financial wellbeing.

Investment basics explained

Let’s face it, investments can be confusing. Get started learning the lingo and understanding the basics.

Super questions answered

Got a burning question about super and retirement? Take an interactive journey through what members are asking and hear answers from our expert team.

learn more about super with impact™

Gutsy advocate for a fair and healthy community

We use our collective voice to help address inequities impacting our members and those we see falling behind.

Investment excellence with impact

We use our expertise and influence to deliver strong long-term returns while accelerating our contribution to a more sustainable world.

Investment excellence with impact >

* SuperRatings 10 Year Platinum Performance 2015-2025 (MySuper)

®Registered to BPAY Pty Ltd ABN 69 079 137 518.