Planning for retirement

Start planning your retirement to get an idea of how much you'll need for the lifestyle you want, and how to maximise your super to help you feel financially prepared and excited when the time comes.

Plan for your retirementWhether you're close to stepping away from work or still building towards it, we'll help you understand your options for a happy retirement.

Start planning your retirement to get an idea of how much you'll need for the lifestyle you want, and how to maximise your super to help you feel financially prepared and excited when the time comes.

Plan for your retirement

Ready to reduce your working hours or boost your super before retirement? See how you can ease into retirement with a Transition to Retirement (TTR) Income Stream.

Retiring soon

A Retirement Income Stream (RIS) is a flexible way to access your super when you retire. You can receive a regular income (tax free if you're 60 or over) while the balance stays invested for you throughout your retirement.

Ready to retire

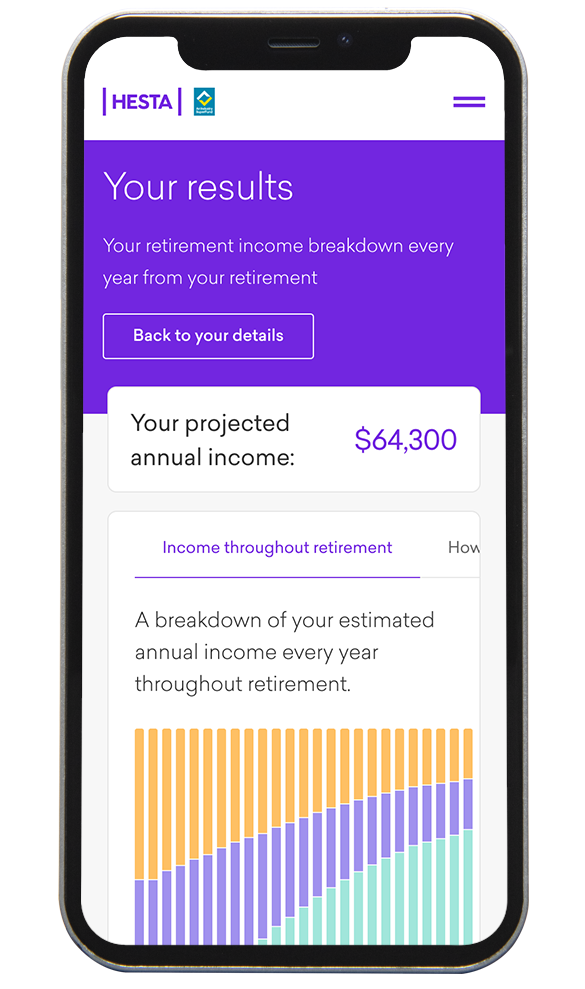

For illustrative purposes only.

Not a member? Join us

Consider whether this product is appropriate for you by reading the PDS and TMD.

Join us to get tips and tools to improve your financial wellbeing and find out what you can do to make the most of your super before retirement.

Find a Super Fit info session

Our experts will talk through options for retirement, tax tips for super and retirement savings, contributions and investment strategies, and what you can do next.

Find a Path to retirement session

HESTA super advisers will talk you through Centrelink and the Age Pension, downsizer contributions, estate planning, investment options and more.

Find a Retirement and beyond session

When can I get access to my super? See when you're eligible to start using your super.

Should I pay off the mortgage or will it affect my Age Pension? Here are a few things for you to consider.

Our Retirement Income Strategy summary may help you decide how you can make the most of this time in your life.

Our Income Stream Ready-Made strategy offers a simple solution to reduce investment risk over time.

Ready. Set. Plan. Our simple online tools are a good starting point for getting your super and finances sorted.

See our income stream forms, including managing your payments, beneficiary nomination form, and more.

Our retirement experts are ready and waiting to guide you through making the most of life in retirement.