Advice and super health checks

As a member, you'll get help from dedicated experts at no extra cost. Join, then book an information session, or a super health check to get your super into good shape.

Learn more about adviceThe money in your super is the savings you have tucked away for retirement. Super can create the retirement you desire and deserve. Here's how it works and how to make it much easier by being with HESTA.

![]()

They must, by law, put on top of your salary into your super account for your retirement. This builds up your super over the years.

![]()

To boost your retirement savings, you can choose to make contributions to your super as well. This could make a big difference to how much money you'll have when you retire.

![]()

To suit your needs and preferences, your super may have death, disability, and income protection cover. It's important to understand any insurance you have, need and want.

![]()

To help grow your super over the long term, this money is invested, and you can choose how. You can keep it invested, even after you retire, so it's worth understanding your options.

Video title: New to Super

Presenter: David Logan, Member Education Manager, HESTA

David Logan: You might have heard people talk about how important superannuation is for your future. But what exactly is it?

Here’s what you need to know.

Superannuation or ‘super’ is designed to help you save and invest your money for your retirement. While that might be a long time away for some, super works best when you add to it regularly throughout your working life.

So how does it work?

Your employer contributes a minimum amount to your super account. That’s called the superannuation guarantee.

On top of this you can make your own extra contributions. Even a little bit extra can really add up over time.

You can choose how you want your money invested. HESTA invests the money on your behalf. Any earnings on your investments are applied to your super account.

Choose how you want your money invested >

Super can be one of the biggest investments you will make. It’s your money and taking an interest in it is one of the best things you can do to prepare for your financial future. And the earlier you start boosting your super, the better off your future will look.

A great thing you can do straight away for your super is to register for an online account. This is the easiest way to keep on top of your super, make contributions and keep your contact information up-to-date.

Register for an online account >

We are a top-performing industry super fund in Australia, and we invest in and for the people who make our world better.

Issued by H.E.S.T. Australia Ltd ABN 66 006 818 695 AFSL 235249, the Trustee of HESTA ABN 64 971 749 321. This information is of a general nature. It does not take into account your objectives, financial situation or specific needs so you should look at your own financial position and requirements before making a decision. You may wish to consult an adviser when doing this. The target market determination for HESTA products can be found at hesta.com.au/tmd. Product ratings and awards are only one factor to be taken into account when making a decision about a financial product. See hesta.com.au/ratings for more information. SuperRatings 10 Year Platinum Performance 2015-2025 (MySuper). Past performance is not a reliable indicator of future performance. Investments may go up and down.

Before making a decision about HESTA products you should read the relevant Product Disclosure Statement (call 1800 813 327 or visit hesta.com.au/pds for a copy), and consider any relevant risks (visit hesta.com.au/understandingrisk).

Your super can work better for you when it’s all together. Plus, you could be paying fewer fees.

Could your super savings get up to a $500 boost from the government? Find out if you're eligible for a co-contribution.

See our forms and brochures, including our Letter of Compliance, beneficiary nomination form, and more.

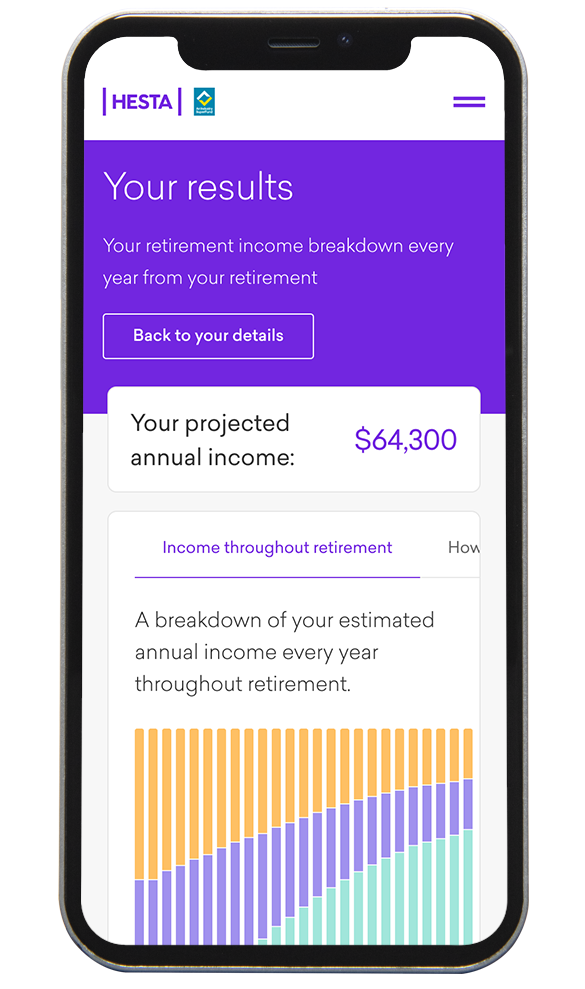

Ready. Set. Plan. Our simple online tools are a good starting point for getting your super and finances sorted.

Need more information on HESTA products and how they work? Take a look at our Product Disclosure Statements.

The tax you pay on super is generally lower than other types of investments. It’s one of the main perks of investing through super.

Extra money you contribute to your super today can add up to a whole lot more in retirement.

Growing your family is an exciting time, but there’s also lots to think about when it comes to your financial future.

As a member, you'll get help from dedicated experts at no extra cost. Join, then book an information session, or a super health check to get your super into good shape.

Learn more about advice

See what people like you want to know about super and money, and get instant answers from our expert team in this interactive video journey.

Watch the interactive Q&A

To talk through anything about super, just get in touch. We'll make it easy. After you've joined, use the app to check your balance, top up, and more.

Contact us

Use Future Planner to:

To use Future Planner, become a HESTA member and then log in to your online account.

For illustrative purposes only.

![]()

Did you know your super is invested? What you should know to help you choose.

How to invest in your future >

![]()

Support through job and family changes to help you sort your super and insurance, understand investments, and more.

![]()

Want super that's easy to set up for your new job and sets you up for retirement?

![]()

Worried about having enough in retirement? Turn concern into confidence.

Giving over 1.05 million members a stronger financial future while working for real-world impact.

* SuperRatings 10 Year Platinum Performance 2015-2025 (MySuper).