market changes and your super

You’ve likely heard about US President Donald Trump recently imposing tariffs across the world, including Australia. We understand that market reactions to this over the last two months might cause some concern about your super.

At HESTA, we’ve been prepared for the policy uncertainty predicted with Trump’s return to the presidency. Volatility in markets can unsettle investors, however it can also present opportunities for those that are prepared. Our investment principles that serve us in good times also guide us through periods of volatility. We continue to focus on the long term and take a proactive and strategic approach to risk.

market volatility update - April 2025

HESTA Chief Investment Officer Sonya Sawtell-Rickson discusses recent market volatility.

Summary

- Markets quickly rising and falling is known as volatility.

- We’re all biased to feel worse about short-term pain rather than good about long-term gain. This can lead to rash decisions about our investments, but given time, investments will generally bounce back.

- HESTA diversifies your investments, and our teams plan for market volatility.

- Set your investment goals and stay disciplined to your strategy.

- Consider your full situation before making an investment decision quickly.

When the world’s markets move, it’s natural to feel concerned about your investments. Rest assured that HESTA has guided our members and their investments through many major market challenges over more than 35 years.

But super isn’t just about us. It’s about you and the life you want to live in retirement. To build your confidence in making the right decision, it can be helpful to learn a bit more about what’s going on with the markets, what you can do, and what HESTA is doing to navigate you to a more secure retirement.

what's going on in the market?

Over the last few years, we’ve seen a lot of news about markets swinging up and down, both in Australia and globally. This is known in finance as market volatility.

Volatility is simply how often and how much investment prices change. Just like how a storm causes bigger waves in the ocean, asset prices go up and down when investors react to global events and trends. Bigger events cause bigger waves, and the peaks and troughs make the biggest headlines. The overall rise and fall generally occurs over an interval of time, which is called the investment cycle.

Watch the video: managing market volatility

Super will have ups and downs. Remember that superannuation is a long-term strategy, and the long-term returns are strong for HESTA members.

What does this mean for your super?

Super, like every investment, will have ups and downs. Super is a long-term strategy, and HESTA has a history of delivering strong long-term returns* for members.

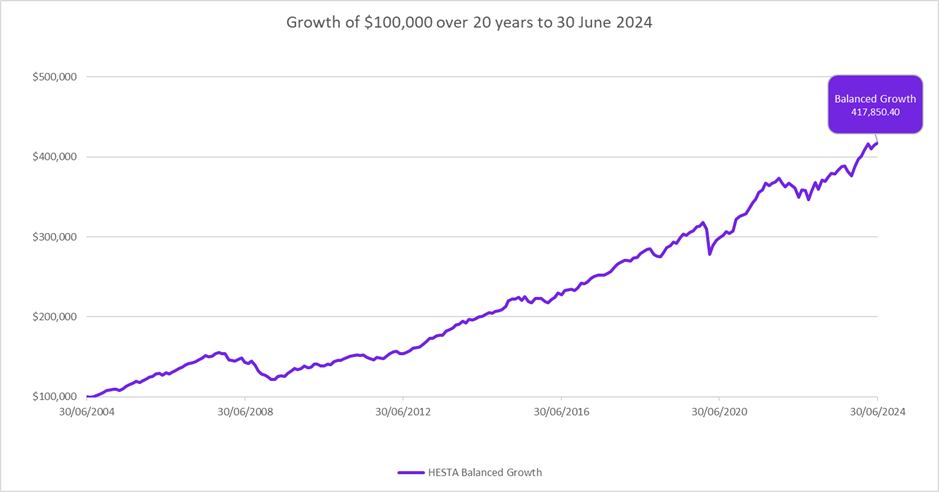

While market volatility is highly publicised in the short term, the graph below shows that even events like the 2008 Global Financial Crisis and COVID-19 are temporary in the context of 20 years of growth in a super product. The example chart below tracks a hypothetical $100,000 that was invested in 2004 in the HESTA Balanced Growth accumulation option.

During 2020 and COVID-related market turbulence, it would have fallen from a high on 31 January 2020, but would have recovered completely by 30 November the same year, or within 10 months. Likewise, the turbulence in 2022 caused a dip from a high on 31 March 2022, but would have recovered by January 2023, again 10 months.

Example: Growth of $100,000 over 20 years (Accumulation only)

Graph depicts scenario: $100,000 invested 1 July 2004 to 30 June 2024 in HESTA Balanced Growth. Calculations are performed on a fixed value over the stated date range and do not take into consideration any transactions (contributions) or deductions (administration/insurance fees and costs) or other entitlements (LISTO, Co-Contributions). Returns are net of investment fees and costs, transaction costs and taxes. Past performance is not a reliable indicator of future performance.

what can you do?

So now that we understand volatility better, what’s a member to do in these times? It may help to consider a few principles:

1. Evaluate and set your goals

Always consider your specific circumstances when planning your goals and strategy. It’s perfectly natural to question whether you’re invested optimally, but make sure you’re fully informed and have taken into account your entire situation in planning and sticking to your investment goals.

2. Keep diversified

After you’ve set your goals, keeping your investments spread across a range of assets is how investors decrease the risk from any one investment. HESTA’s Ready-Made options are designed to achieve broad diversification at defined risk levels, letting our members diversify on their terms but with our scale.

3. Average over time

Another thing many members in the super accumulation phase are already doing to manage volatility is called dollar-cost averaging. Since the Super Guarantee (employer contributions required by law) is fixed amounts paid periodically alongside your wages (12% from 1 July 20252), it is automatically invested for you over the long term. When your super is invested regularly, it begins to average out the cost of purchase so you’re not hit with buying at a high or low point. It’s also one reason HESTA has long been an advocate for payday super, which will require employers to pay your super more regularly, when it is earned.

4. Maximise your net benefit

Super returns are a long-term prospect, but your net benefit is returns minus fees and costs. SuperRatings has awarded HESTA with its Net Benefit award3 for four out of the last five years4, reflecting the continued value we strive to provide our members.

5. Stay disciplined

As we’ve shown, it’s natural to want to adjust our investments at the top and bottom of these waves. However, it’s nearly impossible to always accurately pick the highs and lows. The old investing adage, “time in the market beats timing the market” has been shown repeatedly by studies and our own experience. If your strategy is well-considered, take stock of whether or not short-term market volatility calls for reevaluating your long-term situation. And remember, as a HESTA member advice about your super is a click or call away5.

* Investment returns may go up and down. Past performance is not a reliable indicator of future performance.

2 If over 18 years old, or under 18 years old and working over 30 hours a week. This is increasing to 12% on 1 July 2025.

3 This award recognises HESTA as the Australian super fund with the best net benefit outcomes (including returns and costs) delivered to members over the short and long term. Product ratings and awards are only one factor to be considered when making a decision.

4 The rating is issued by SuperRatings Pty Ltd (SuperRatings) ABN: 95 100 192 283 a Corporate Authorised Representative (CAR No.1309956) of Lonsec Research Pty Ltd ABN 11 151 658 561, AFSL No. 421445 (Lonsec Research). Ratings are general advice only and have been prepared without taking account of your objectives, financial situation or needs. Consider your personal circumstances, read the product disclosure statement and seek independent financial advice before investing. The rating is not a recommendation to purchase, sell or hold any product. Past performance information is not indicative of future performance. Ratings are subject to change without notice and SuperRatings assumes no obligation to update. SuperRatings use proprietary criteria to determine awards and ratings and may receive a fee for the use of its ratings and awards. Visit superratings.com.au for ratings information. © 2025 SuperRatings. All rights reserved.

5 Fees for advice may apply.

Check in on your super

It could be your biggest asset one day. Your online account lets you check your super balance, keep your account up to date and much more, 24/7.